CS 4790

Cryptocurrency

Overview

Aaron Bloomfield (aaron@virginia.edu)

@github | ↑ |

Introduction

What is money?

- Four functions (Jevons, 1875):

- medium of exchange

- common measure of value (or unit of account)

- standard of value (or standard of deferred payment)

- a store of value

Money’s a matter of functions four,

A Medium, a Measure, a Standard, a Store

Types of currencies

- Commodity currency: made from actual valuable commodities, such as gold

- “gold pieces” in role-playing games

- Representative currency: one that is backed up by a valuable “thing”, such as gold

- When the US dollor was on the “gold standard”

- Fiat currency: established by the government “by fiat”

- What the US dollar is (now)

- Cryptocurrency (obviously)

What is a cryptocurrency?

- A digital asset designed to work as a medium of exchange

- “a widely accepted token which can be exchanged for goods and services”

- What all modern currencies are (or are intended to be)

- They use modern cryptographic technologies (encryption and hashing), hence the name

What is a cryptocurrency?

According to Jan Lansky (source) it has the following six properties:

- No central authority, and its state is maintained through distributed consensus

- The system keeps an overview of cryptocurrency units and their ownership

- The system defines whether new cryptocurrency units can be created and how

- Ownership of cryptocurrency units can be proved exclusively cryptographically

What is a cryptocurrency?

According to Jan Lansky (source) it has the following six properties:- The system allows for transactions (transfers), which can only occur from the entity that can prove ownership of the source currency

- If two different instructions for changing the ownership of the same cryptographic units are simultaneously entered, the system performs at most one of them

Consider the AaronDollar™

- Would you pay me 1 dollar for it? What about

$10?$100? -

If I told you it would buy you an A+ in this course…

-

Would you pay me

$100 then?

-

Would you pay me

What makes money worth anything?

- A currency has value if people believe that it has value based on:

- It being widely accepted

- It being backed by a stable government or entity

- It having a reasonable inflation rate

- It being exchangeable for something else of value

Currency examples

- Some examples:

- The US Dollar is the most widely used in international financial transactions

Due to the crisis in Venezuela, the Venezuelan bolivar soberano (VEB), and its predecessor the bolivar fuerte, are essentially worthless

Due to the crisis in Venezuela, the Venezuelan bolivar soberano (VEB), and its predecessor the bolivar fuerte, are essentially worthless

- The VEB had a 1,698,488% (yes, 1.7 million percent) inflation rate in 2018

- And about 5,000% in 2020

- El Salvador

- Official currencies: USD and BTC

- Thus, little control over monetary policy…

- In 2021 they mined

$269 in BTC for$4,672 (source)

What makes a digital currency worth anything?

- This means currencies for which there is no non-digital equivalent

- It is worth something if:

- It is widely accepted

- Entities are willing to exchange it for goods or other currencies

- It can be exchanged for something else

Cryptocurrencies

- There are 8,992 existing cryptocurrencies (that have value)

- As per investing.com (as of Jan 12, 2026)

- One estimate is that 100 new ones are created each day

- Most don’t make investing.com’s list

- Some are Ponzi schemes, some are pyramid schemes, and some are worthwhile

- Their value comes in if they are widely accepted, and very few are

- You can see a list of the 100 most popular cryptocurrencies by market capitalization

- Bitcoin was the first, the most widely accepted, and the most stable, so it will be focused on in this slide set

Bitcoin Basics

A note about numbers…

- The data in this slide set was all updated for the current semester (as of Jan 12, 2026)

- Bitcoin is highly volatile (the value changes so fast) that it is likely to be quite different in a day or two

- Indeed, the value of a Bitcoin changed during the updating of the numbers!

- So you will see (slightly) different values for the price, for example

- Indeed, the value of a Bitcoin changed during the updating of the numbers!

- Also, most of the graphs are from the previous day

Bitcoin

- The first viable cryptocurrency,sss it was created in 2008 by Satoshi Nakamoto

- That’s a pseudonym; nobody knows who the real person (or group) that created it

- Although the person is likely British

- It is now fully open source

- It was also one of the first digital-only currencies that didn’t bankrupt the creator

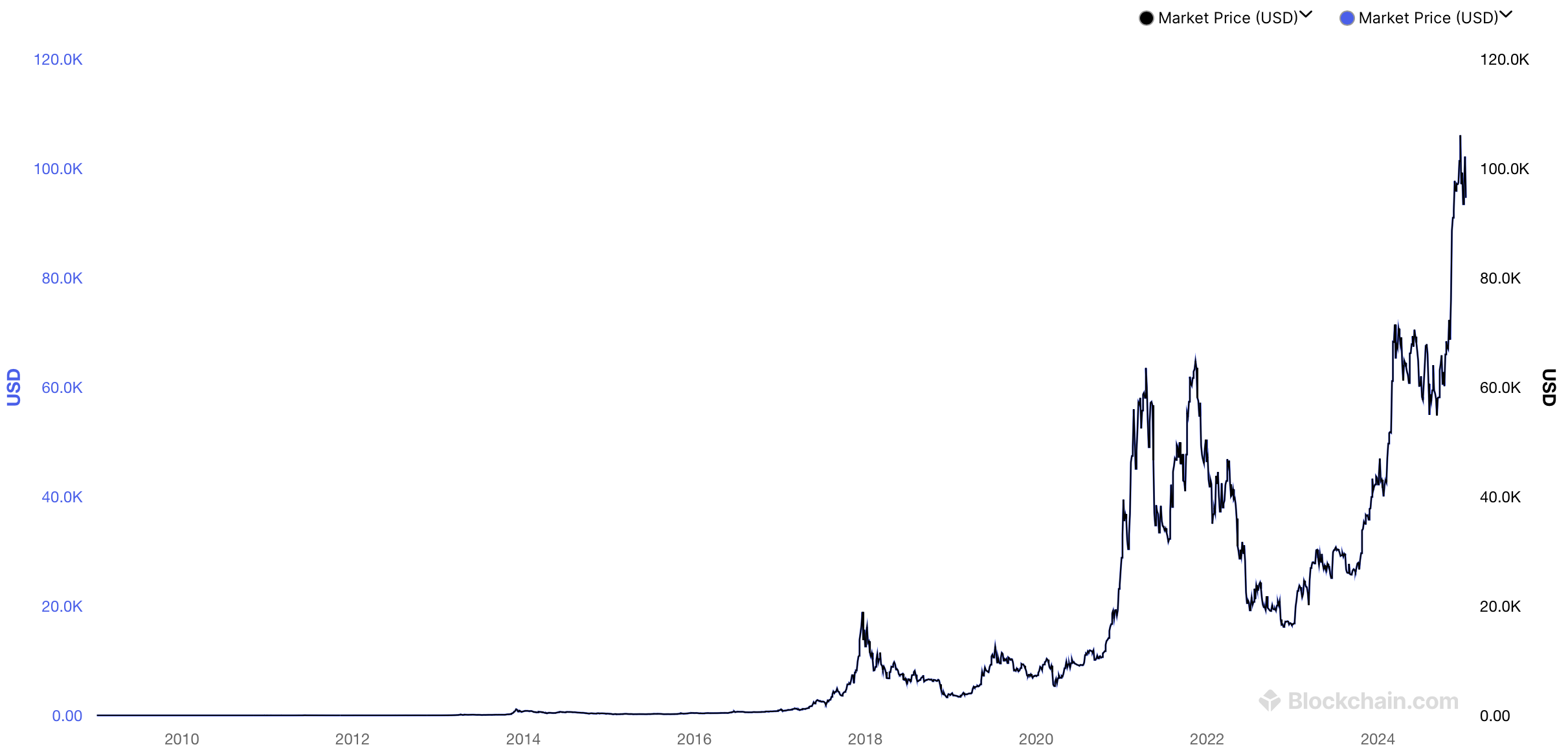

Bitcoin price

From blockchain.com; BTC peaked at $126,032 in October 2025 (source)

Peer to peer

- Bitcoin is completely peer to peer

- No central authority!

- When a decision has to be made…

- … such as which mined block to accept (more on that later)…

- … the nodes vote on the choice

- This means little regulation, but also lots of privacy

Wallets

- You create a bitcoin wallet, which contains (possibly many) public/private key sets

- Many software programs can create this for you

- With such rampant Bitcoin theft, hardware wallets are much more secure

- Transfers are between the public keys of the wallets, but require signing by the private key

- If you lose your private key (or forget the password it’s encrypted with), there is no way to get your Bitcoin back

Anonymity and usage

- Bitcoin allows for (mostly) anonymous transactions

- You only publish your wallet’s public key

- … but lately it’s been possible to trace people…

- Thus, it’s also used for illegal things:

- Tax evasion

- Purchasing of illegal items

- Transfers of money without oversight

Transactions

- You state you want to transfer x from yourself (S) to a destination (D)

- S and D are the public keys of the wallets

- You also include the hash of the transaction(s) where you got the money

- You sign all this with your wallet’s private key

- You then broadcast this to the P2P network

- This takes up to 30 minutes for the transaction to occur

- This prevents double spending

- And this is partly for mining reasons we will see shortly

The mempool

- All transactions not yet on the blockchain are stored in a memory pool or mempool, which is public

- Maintained by a network of “equally privileged miners”

- Every 10 minutes or so, all the transactions are combined into a single block

- That block becomes part of the blockchain (through mining)

Blockchain

- The first block was the “genesis block”

- Each successive block includes the SHA-256 hash of the previous block

- Thus, you can’t make a change to a previous block without changing all successive blocks

- The current blockchain (as of Jan 12, 2026) is 932,038 blocks (aka ‘height’) (source)

- About 696 Gb in size (source)

Simple Blockchain

- Each block is mined by somebody

- That creates currency as a reward

- A block contains the hash of the previous block

- They typically don’t include the hash of that block; it’s put into the diagram for clarity)

- A block may contain transactions

Mining

Mining

- Mining is just a record keeping operation

- It is the process that creates the blocks of blockchain

- A block consists of:

- A listing of the transactions over the last 10 (or so) minutes

- The SHA-256 hash of the previous block in the chain

- A nonce (described later), which is just a number

- The process is intentionally computationally intensive, and generates BTC as a reward

Mining

- A transaction is not considered to have occurred until it is mined to the blockchain

- Thus, mining is essential to the Bitcoin system working at all

- Without mining, no transactions would occur, and it becomes useless

- So how do we encourage people to contribute to this mining process?

- Answer: give them BTC for doing so

Target

First target

- The first target was defined as: 00000000ffff00000000000000000000 00000000000000000000000000000000

- (that’s 8 hex 0’s, 4 hex f’s, then 52 hex 0’s)

- To properly mine a block, your nonce must create a SHA-256 hash below that value

- With 8 leading hex 0’s, the chance of a random nonce working is \((1/16)^8 = 1/(2^4)^8=1/2^{32}\)

- Or 1 in about 4.3 billion

Difficulty

- First target (\(ft\)): 00000000ffff00000000000000 00000000000000000000000000000000000000

- The current target (\(ct\)) is 00000000000000000001ebf2 0000000000000000000000000000000000000000

- As of Jan 12, 2026 and derived from the nbits value of 0x1701EBF2 from the latest block

- The new target is harder than the old: specifically \(ft/ct\) = 146.47 trillion

- This number is the bitcoin difficulty, and the latest value can be found here

Current hash difficulty

- For the first target, a random nonce had a 1 in 4.3 billion chance of success

- The current target is 146.47 trillion times harder

- A random nonce now has a 1 in \(6.29 \times 10^{23}\) chance of success

How long this will take

- A typical CPU can do maybe 10 Mhash/sec (million hashes per second)

- A very fast CPU today could do about 25 Mhash/sec

- A $1,500 video card today could do about 1 Ghash/sec (estimate based on this and this)

- 1 Ghash/sec is 40 times faster than a CPU

- Consider a 1 in \(6.29 \times 10^{23}\) chance of success

- To generate \(6.29 \times 10^{23}\) hashes at 1 billion (1 Ghash) per second on a fast graphics card, this will take 24.9 million years

- A CPU is 40 times longer: about 1 billion years

Electricity usage

Why so hard?

- Mining generates a reward so that:

- People are encouraged to mine, which will allow for proper record keeping

- The system can add BTC over time as more transactions occur

- Adding money into an economy is something that countries do, and (when done responsibly) is good financial policy

- Because of the reward, mining is intentionally difficult to do

Why so hard?

- The mining difficulty is set so that the time to compute one block will take approximately 10 minutes

- The more computational resources that are devoted to mining, the harder the difficulty will be

- The difficulty is recomputed every 2016 blocks

- If a block takes exactly 10 minutes, that’s every 2 weeks

- The difficulty is adjusted to meet the 10 minute per block target

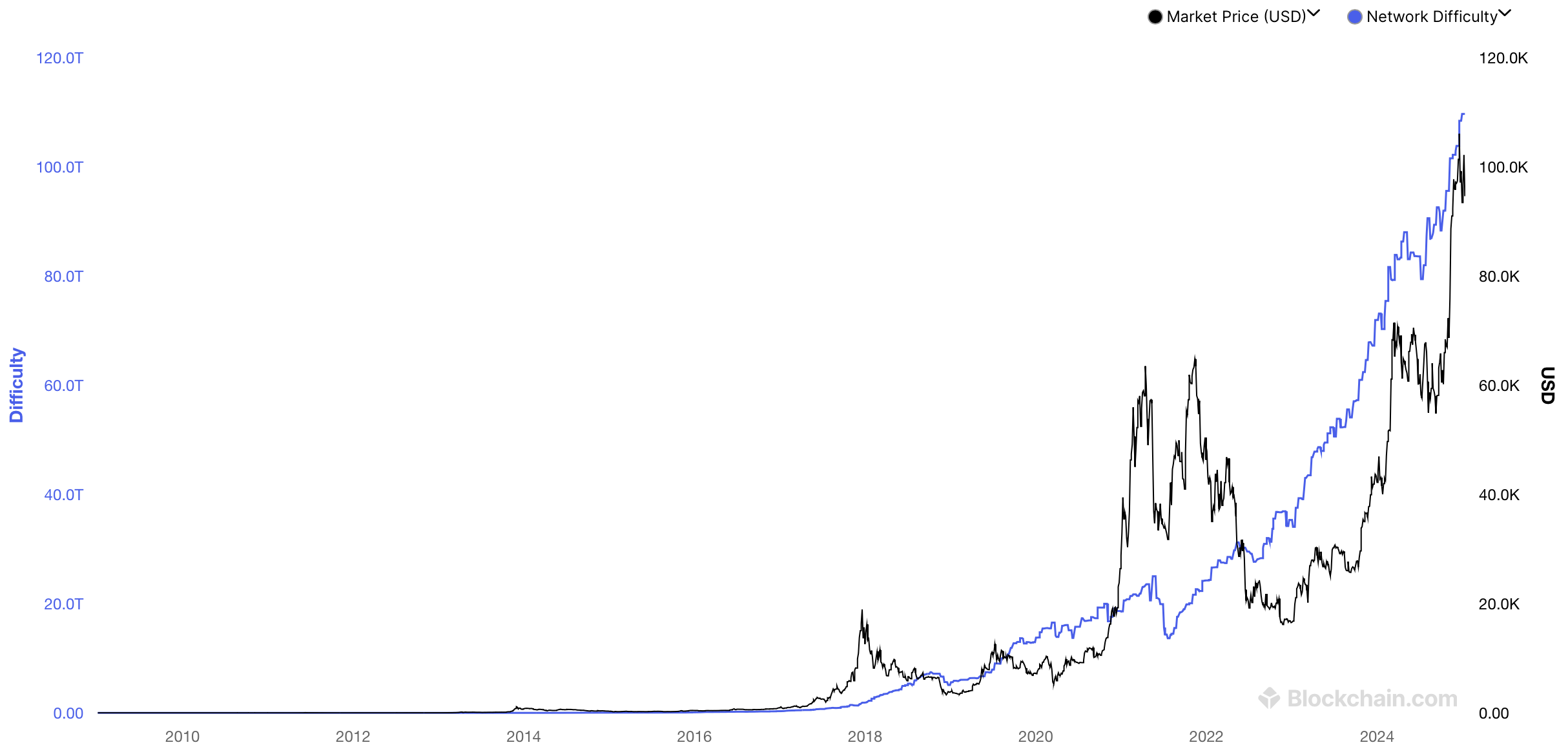

All-time difficulty graph from blockchain.com

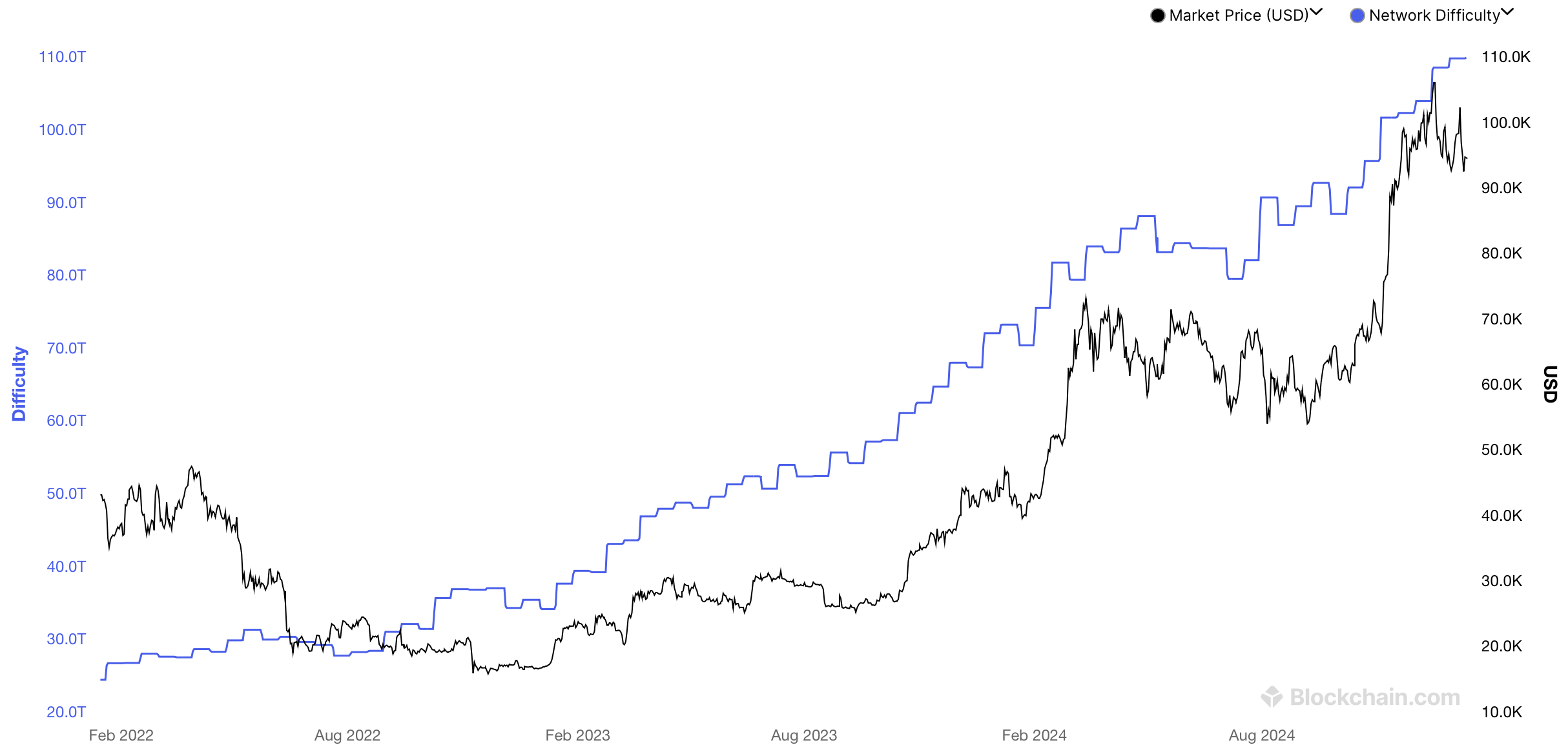

Last 3 years difficulty graph from blockchain.com

Reward per block

- The reward for computing a block was 50 BTC in block #1

- It halves every 210,000 blocks

- At about 10 minutes per block, that’s about every 4 years before it halves

- This is the creation of new BTC, and how currency is added

- As the reward becomes smaller, transaction fees will kick in to help

Reward per block

- The current reward (as of Jan 12, 2026) is 3.125 BTC

- Plus transaction fees of around 0.1 BTC or so

- The estimated date when it drops to 1.56 BTC is mid April 2028 (source)

- At a price of about $91k per block (source), 3.225 BTC is about $293k for a properly signed block

- But if it costs almost 13 billion dollars in electricity, perhaps it’s not all that worth it

- Unless you use somebody else’s electricity…

Current state of mining

- Needless to say, CPUs and graphics cards are no longer viable to use for mining

- Special purpose hardware (ASICs) can be bought online

- Many people use company resources for the mining

- Others use botnets

- Javascript mining programs are found on many web pages, and run in your browser

- Thus, they are using your electricity for their financial gain

- But probably not mining BTC…

Pooled mining

- If it would take your high-end GPU 10 billion years to compute a block, and blocks need to be computed every 10 minutes, then you aren’t going to get very far on your own

- Mining pools aggregate many resources, and distribute any rewards based on the computational resources provided to the pool

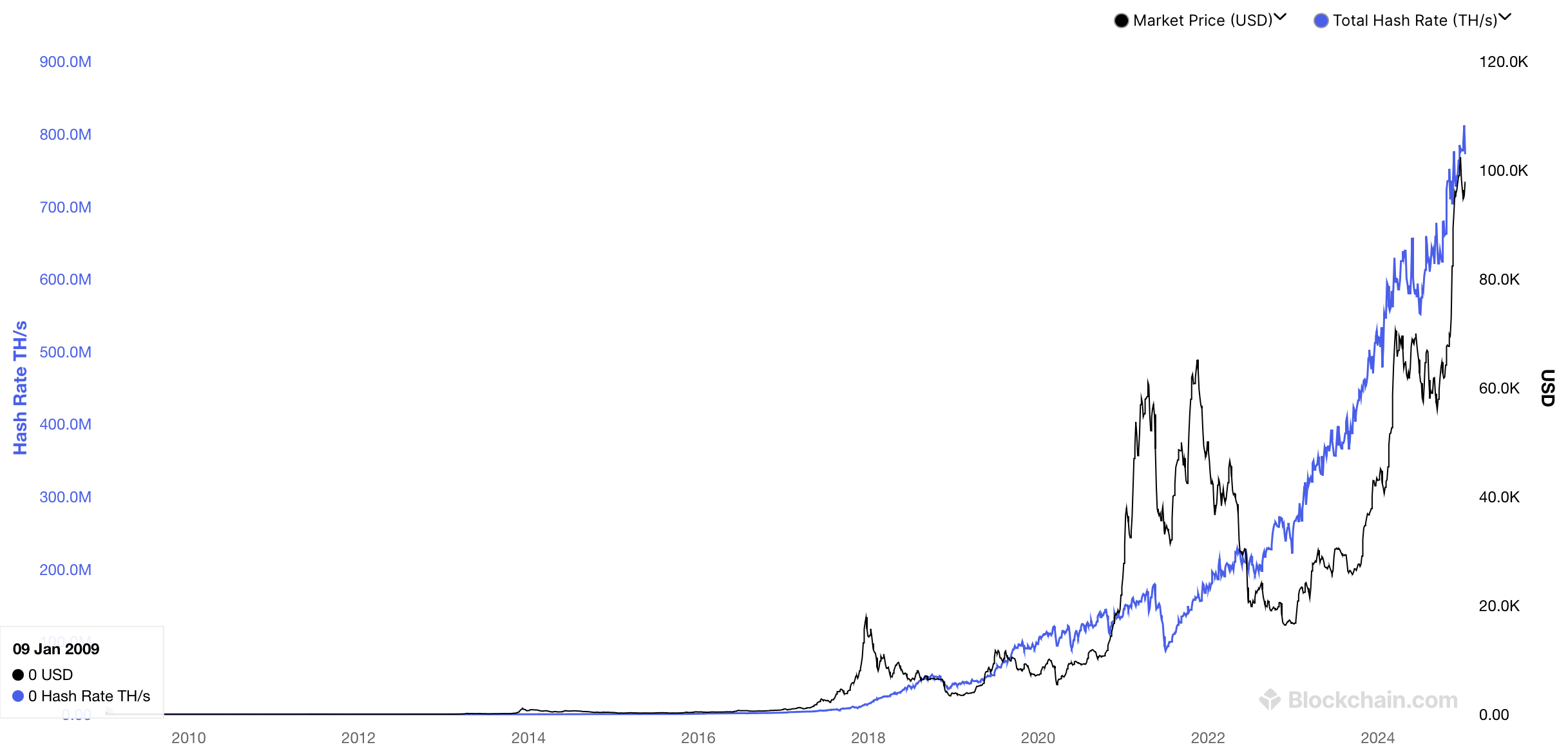

Hashes per second

From blockchain.com, and for the entire Bitcoin network: 1.06 zetahashes per second (zeta = \(10^{21}\))

Mining hardware

- A whole industry has sprung up: you can find the hardware online (such as here)

- These devices are much faster and use much less electricity

- Consider the DragonX AntMiner S19k, which costs

$1,000 (as of Jan 12, 2026)- It can compute 120 Thash/sec (tera), or \(120 \ast 10^{12}=1.2 \ast 10^{14}\) hash/sec

- I don’t believe their numbers that they posted at that link, though

Mining profitability

- A reasonable profit margin estimate:

- For a investment of \(x\) dollars in mining equipment, you might make one-tenth of that per month

- If you are lucky!

- So you will start to make a profit in about two years, assuming that the difficulty doesn’t go up that much

- For a investment of \(x\) dollars in mining equipment, you might make one-tenth of that per month

- But this does NOT include electrical costs!

- Keep in mind that if this were really profitable, then everybody would jump in on it, and the difficulty would just jump up, causing it to become suddenly less profitable

DragonX AntMiner S19k analysis

- We know that:

- The current hash rate is about 1.06 ZH/s

- Blocks take about 10 minutes to process (actually about 9m 56s right now (source))

- The DragonX AntMiner S19k claims to hash 120 TH/s

- 1.06 zeta / 120 tera = \(1.06 \cdot 10^{21} / 120 \cdot 10^{12} = 4.45 \cdot 10^{6}\) or about 8.83 million

- Thus, you would expect to get one 8.8-millionth of a block’s reward in a pooled setup

- At

$293k per block, that’s about 3.3 cents per block - (And we aren’t counting electricity here)

DragonX AntMiner S19k analysis

- At

$293 per block, that’s about 3.3 cents per block- Which is $4.78 per day

- This assumes 10 minute blocks; it’s a bit more with 9m 56s blocks

- You will make back your initial investment of

$1,000 (plus tax) 250 days- That’s 8.3 months

- Which is $4.78 per day

- This assumes that the numbers don’t change!

- And that you aren’t paying for electricity

- And we know the reward per block will go down in late April of 2028…

- There is also one available that mines twice as much but costs 3.5 times as much, and uses only 34% more power

DragonX AntMiner S19k analysis

- You will make $4.78 in BTC per day

- But… electricity is not free

- Stated power usage: 2,760 W or 2.76 kW

- Over 24 hours that’s \(24 * 2.76 = 66\) kWh

- At Charlottesville’s rate of 15¢ per kWh, that’s

$9.93 per day- About

$298 per month

- About

- So your total daily profit is:

$4.78 -$9.93 or- Negative

$5.15 cents per day!

- Negative

When is Bitcoin mining profitable?

- When you don’t pay for electricity

- Apartment rental where utilities are included in the rent, for example

- Using computers that are not your own

- Malware, running it on another cluster, etc.

- When done on a large scale

- One can make deals with power companies, relocate where power is cheaper, buy miners cheaper, avoid import tariffs, etc.